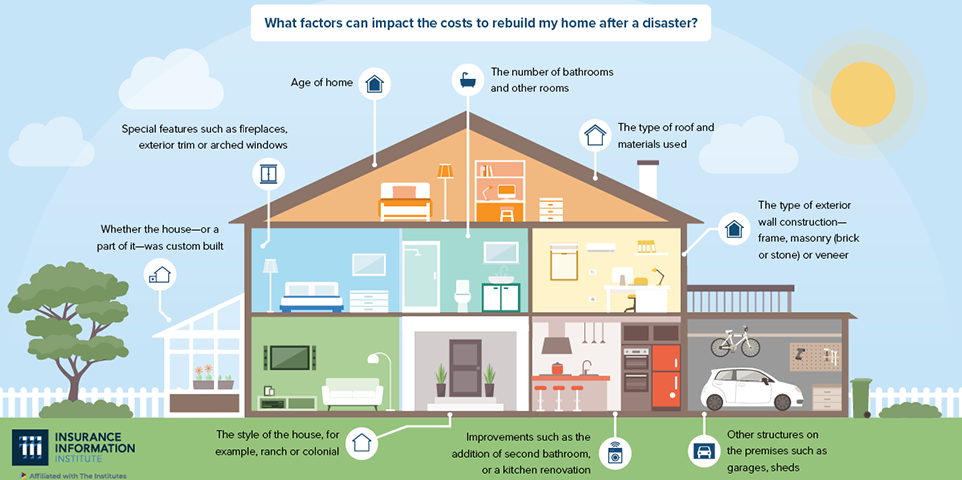

Purchasing a home can be an exciting event that can also come with new responsibilities and questions, especially for first-time buyers. One primary challenge is having a sound financial plan to pay repair or rebuilding costs if the house becomes damaged by peril–fire, earthquake, storm, etc.

A homeowners insurance policy with the right type and amount of coverage can help protect a buyer's investment and financial future. This benefit is why lenders may require proof of a policy before the final approval of a mortgage. Remember, homeowners insurance is not the same as mortgage insurance.

To discover essential information on how to make sense of these and other concerns in line with your financial goals, take a look at the Homebuyers Insurance Handbook.

The Insurance Information Institute (Triple-I) and the National Association of REALTORS (NAR) created this handy guide to help you learn and discuss your insurance needs with an insurance professional. Longtime homeowners can also find tips on choosing the right amount of coverage to protect their investment.

Additional resources